FY2025(March 1,2025 to Feburuary 28,2026) Interim Dividend

1. Interim Dividend: ¥25.00 per share

2. Effective date and payment date: Friday, November 14, 2025

Dividend Policy

AEON Financial Service sees returning profits to shareholders as a management priority. Our basic policy is to appropriately allocate profits to shareholders and retain funds internally to expand our businesses and improve productivity to enhance corporate competitiveness.

The Articles of Incorporation state that matters specified in each item of Article 459, Paragraph 1 of the Companies Act, such as the distribution of surplus, shall be determined by a resolution of the Board of Directors, not by a resolution of the meeting of shareholders, unless otherwise provided by laws and regulations.

In addition, although the Company's basic policy is to distribute surplus profits twice a year as an interim dividend and a year-end dividend, the Articles of Incorporation state that the Board of Directors may declare dividends at any time during the fiscal year.

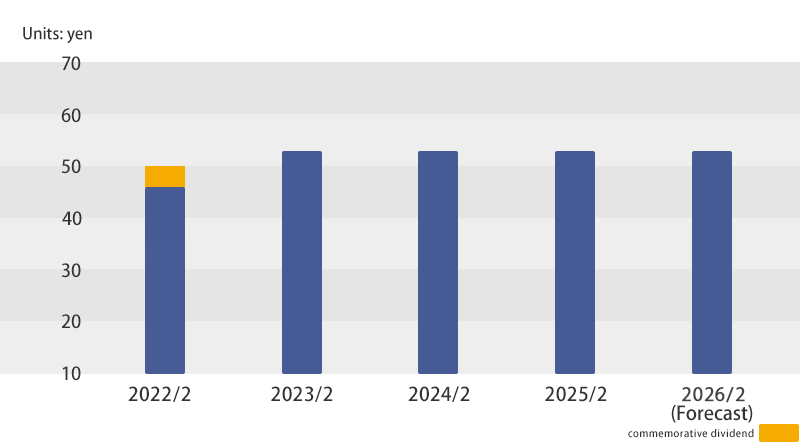

Dividend Payments per Share

For the fiscal year ending February 28, 2026, the company plans to pay an annual dividend of 53 yen (dividend of 25 yen at the end of the second quarter and dividend of 28 yen at the end of year).

*Annual totals

| Interim dividend | End of year dividend | Total dividend | |

|---|---|---|---|

| FY2025 | ¥25 | ¥28(Forecast) | ¥53(Forecast) |

| FY2024 | ¥25 | ¥28 | ¥53 |

| FY2023 | ¥25 | ¥28 | ¥53 |

| FY2022 | ¥20 | ¥33 | ¥53 |

| FY2021 | ¥19 (Included a commemorative dividend of ¥2 per share) |

¥31 (Included a commemorative dividend of ¥2 per share) |

¥50 (Included a commemorative dividend of ¥4 per share) |

| FY2020 | ¥11 | ¥23 | ¥34 |

| FY2019 | ¥29 | ¥39 | ¥68 |

| FY2018 | ¥29 | ¥39 | ¥68 |

| FY2017 | ¥29 | ¥39 | ¥68 |

| FY2016 | ¥29 (Included a commemorative dividend of ¥1 per share) |

¥39 (Included a commemorative dividend of ¥1 per share) |

¥68 (Included a commemorative dividend of ¥1 per share) |

| FY2015 | ¥28 | ¥38 | ¥66 |

| FY2014 | ¥25 | ¥35 | ¥60 |

| FY2013 | ¥25 | ¥35 | ¥60 |

| FY2012 | ¥20 | ¥25 | ¥50 ※2 |

| FY2011 | ¥15 | ¥25 | ¥45 ※1 |

| FY2010 | ¥15 | ¥25 | ¥40 |

| FY2009 | ¥15 | ¥25 | ¥40 |

| FY2008 | ¥15 | ¥25 | ¥40 |

| FY2007 | ¥15 | ¥25 | ¥40 |

| FY2006 | ¥15 | ¥25 (¥5 of commemorative dividend included) |

¥40 |

| FY2005 | ¥35 | ¥55 | ¥90 |

| FY2004 | ¥30 | ¥40 | ¥70 |

| FY2003 | ¥25 | ¥35 | ¥60 |

| FY2002 | ¥25 | ¥30 | ¥55 |

| FY2001 | ¥20 | ¥30 | ¥50 |

| FY2000 | ¥15 | ¥25 | ¥40 |

| FY1999 | ¥20 | ¥15 | ¥35 |

| FY1998 | ¥20 | ¥15 | ¥35 |

| FY1997 | ¥15 | ¥15 | ¥30 |

| FY1996 | ¥10 | ¥20 | ¥30 |

| FY1995 | ¥10 | ¥15 | ¥25 |

- *To receive dividends, purchase of shares at least two business days before the shareholder rights record date is required (end of February for end of year dividends, end of August for interim dividends).

- The Company paid commemorative dividends of \5 per share with a record date of November 20, 2011 for fiscal year 2012.

- The Company paid commemorative dividends of \5 per share with a record date of January 4, 2013 for fiscal year 2013.

Stock Splits

As we promote long-term stability in the value of our shares, we are aware of the critical need to expand our investor base and improve the liquidity of our shares. Along the way, we have changed the size of our stock trading lot and implemented stock splits as necessary.

| Date | Stock split |

|---|---|

| Febluary 21, 2006 | 1 : 3 |

| April 10, 2003 | 1 : 1.1 |

| February 10, 2000 | 1 : 2 |

| April 8, 1999 | 1 : 1.1 |

| February 17, 1998 | 1 : 1.2 |

| April 10, 1997 | 1 : 1.2 |

| April 10, 1996 | 1 : 1.1 |

| April 10, 1995 | 1 : 1.1 |